The Trusted Community for Navigating Wealth

Empowering high-net-worth individuals with peer insights, authentic relationships, and curated investment opportunities.

No Membership Fees.

O N E C O M M U N I T Y

Unlimited Potential

D I S C O V E R T H E

Power of Collective Growth

7,500+

Members

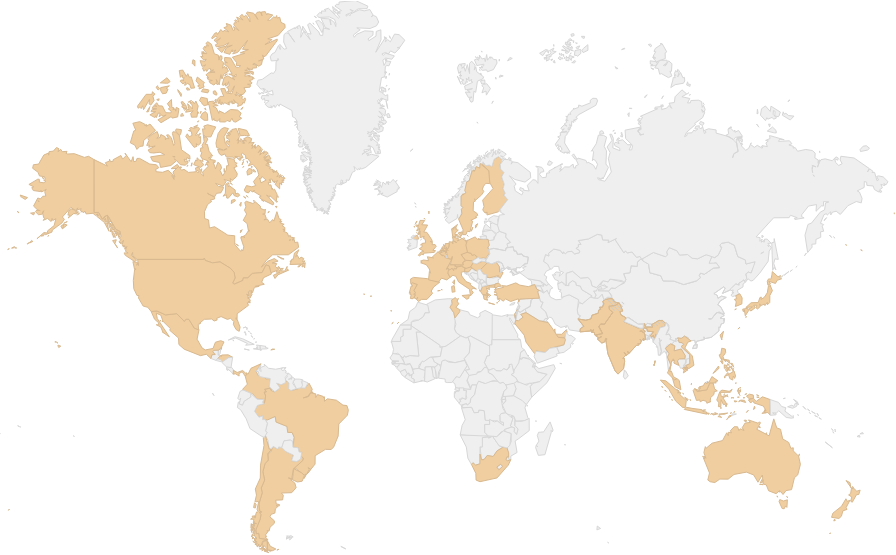

45+

Countries

$400M+

Capital Deployed

$0

Membership Fees

$15M

Average Net Worth

45

Average Age

E X P E R I E N C E T H E

Guidance From Trusted Peers

L O N G A N G L E

Member Benefits

-

High-Net-Worth Peer Network and Community

Long Angle understands the challenges of wealth. Get real advice from trusted peers who've achieved similar success—no products to sell, just insights from those who understand your level.

-

Institutional-Grade Alternative Investments

Long Angle successfully deploys $100M+ annually across asset classes like private equity and private credit. Members leverage collective expertise and scale for better terms.

-

In-Person Events, Virtual Workshops, and More

Connect with accomplished peers at regional dinners, exclusive workshops, and our annual 5-star retreat. Intimate events foster genuine relationships beyond networking.

-

Trusted Circles: High-Net-Worth Peer Groups

Join vetted circles of 6-8 high-net-worth peers navigating post-success decisions. Monthly confidential discussions on wealth optimization, exit planning, and legacy building.

"Depth and engagement I didn't expect."

— Leigh Rowan

"A trusted space for real answers from real peers."

— Christina Lewis

"People see who you are now."

— Onkur Sen

B U I L D Y O U R P E E R N E T W O R K:

Join Our High-Net-Worth Community Today

Access a diverse network of like-minded individuals for confidential discussions, engage in live events and workshops, join expert-led peer advisory groups, and explore exclusive opportunities in private markets.