Access Institutional-Grade Alternative Investments

Access private markets through Long Angle’s highly curated and vetted investment opportunities. Leverage the collective expertise and scale from our high-net-worth investor community.

No Membership Fees.

The Rise of Alternative Investments

Over the past several decades, institutional investors have increasingly recognized the power of alternative assets in portfolio construction. This shift has led to the growth and consolidation of private markets, with fundraising experiencing a threefold increase in the past decade alone.

With Long Angle, you can access private market investment opportunities that were previously only available to pensions, endowments, sovereign wealth funds, and family office investors.

Building Your Institutional-Grade Alternative Investments Portfolio

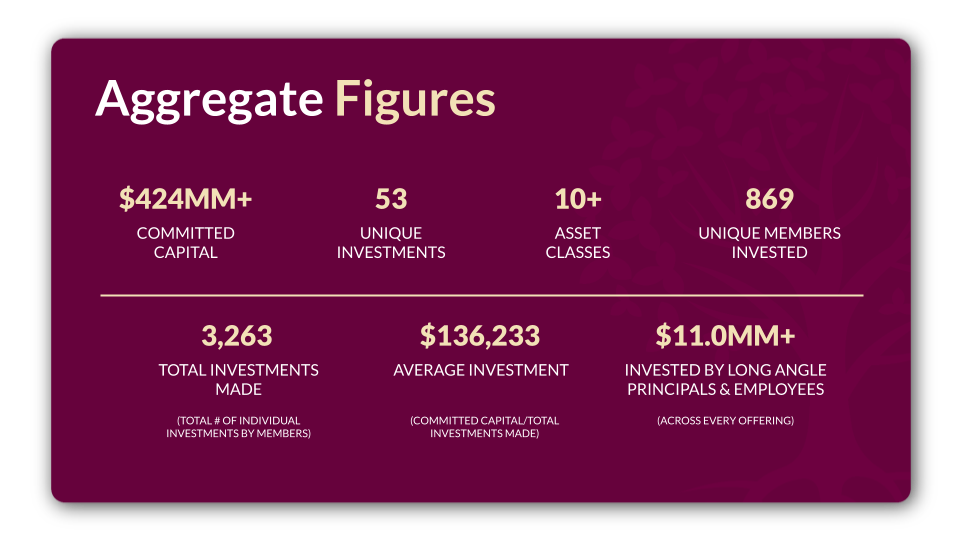

With hundreds of million in committed capital and over 40 Special Purpose Vehicles (SPVs) deployed, Long Angle enables you to build an institutional-grade portfolio of alternative investments. We provide exceptional access to diverse opportunities across asset classes like Private Equity, Search Funds, and Private Credit to Secondaries, Venture, and Energy.

Long Angle only brings opportunities that offer exceptional value, including exclusive allocations, lower investment sizes and minimum commitments, and negotiated fee adjustments, making investing through us more cost-efficient than direct investments.

A Transparent Approach to Alternative Investment Evaluation

At Long Angle, we prioritize transparency. Investors have access to the full suite of diligence materials reviewed by our Investment Team, including recorded diligence calls. Our meticulous process involves selecting best-in-class managers and fund opportunities, rigorous analysis and underwriting for each offering, and a strategic asset allocation. We focus on returns, market correlation, fees, sponsor history, unique risks, and tax implications.

Our commitment to transparency extends beyond underwriting; members can access regular updates on offerings and participate in our quarterly calls to monitor the performance of Long Angle’s investments.

Participation is Optional

Participation in Long Angle deals is completely optional. Members are welcome to review every deal without any expectation of participation. Members make their own investment decisions based on their personal objectives, and we do not want anyone to participate in any investment they do not personally understand and have conviction in.

From Our Members

A C C E S S A L T E R N A T I V E I N V E S T M E N T S:

Join Our High-Net-Worth Community Today

Access a diverse network of like-minded individuals for confidential discussions, engage in live events and workshops, join expert-led peer advisory groups, and explore exclusive opportunities in private markets.