Evergreen Private Equity Secondaries: Investment Guide 2025

Cliffwater, Private Equity’s Secondary Act

Looking for a trusted network of high-net-worth peers? Apply now to join Long Angle, a vetted community where successful investors, entrepreneurs, and professionals connect. Access confidential discussions, live events, peer advisory groups, and curated investment opportunities.

Part 3 of the Evergreen Secondaries Series: Long Angle’s Evergreen Private Equity Secondaries Investment Guide 2025 is a primer on private market evergreen secondary funds. The guide introduces evergreen secondaries, breaks down key benefits for investors, and illustrates how early-close investors gain a performance advantage. It also explains common terminology and highlights performance and risk considerations to help readers more confidently evaluate if evergreen secondaries are a fit for their portfolio.

Table of Contents

Access the Full Investment Guide Here

What are Evergreen Secondaries?

Evergreen secondary funds offer investors access to existing interests in a private fund or asset via a perpetual investment vehicle.

With no fixed maturity, evergreen fund investors can subscribe (invest) or redeem (liquidate) shares periodically, typically quarterly or semi–annually—which diverges from more typical closed-end private equity funds that offer no liquidity except on natural realization events.

Evergreen secondaries combine the advantages of both evergreen and secondary fund structures:

Evergreen Benefits:

Enhanced liquidity

Full upfront capital deployment to put investment dollars to work immediately rather than spread over multiple years during an investment period

Secondaries Benefits:

Purchase discounts

Diversification

Elimination of the J-curve

Read our Evergreen Fund Investment Guide 2025 and Secondaries Investment Guide 2025 for introductory primers on the two strategies.

Evergreen Secondaries Fund Lifecycle

The evergreen secondary fund lifecycle consists of the initial fund launch, or first close, followed by subsequent investment windows over time. The sponsor typically purchases at a discount to the underlying asset holdings’ NAV (net asset value—the total value of an entity’s assets minus liabilities) to provide liquidity to parties selling illiquid assets.

Once the discounted investment is made, the fund sees an immediate markup after close (e.g. a fund buys an asset for $80M but its underlying value is $100M). The uplift in returns that investors receive buying assets below their NAV is referred to as the “discount premium.”

The evergreen secondary fund lifecycle consists of three phases based on inflows (newly committed capital) and outflows (distributions) that relate to the discount premium:

Net inflows phase: initial years

First and early close investors get compounding exposure to discounted purchases as the fund grows through inflows and recycling (reinvesting capital returned from realizations—exits, dividends, interest, or distributions).

Balanced inflows and outflows: mid-fund cycle

Mid-fund cycle investors in a stabilized fund which matches inflows and outflows can expect their performance to resemble the discount premium rate from recycling of realizations into new discounted premiums.

Net outflows: last few years

Investors in this “last-dollar-in cohort” will receive no discount premium as the fund begins to wind down and outflows match realizations. Their positions will simply have an economic interest in a diversified pool of assets that have 1) mitigated the J-curve and 2) maintain appreciation and income potential.

Later investors are paying a second layer of fees (the underlying assets all have fees, and the evergreen manager also charges a fee) making the investment subpar from a risk adjusted returns perspective if the fees are not worth the diversification and J-curve mitigation.

This fund lifecycle creates a structural advantage for early-period investors during the net inflows phase. This is colloquially referred to as the “n-curve.”

N-Curve Advantage for Early Investors

Acquisitions at a discount to NAV typically lead to immediate increases in portfolio values, resulting in a positive return arbitrage and a foundation for later compounding. This creates the "n-curve." Ares defines the n-curve as:

“The phenomenon where a secondaries fund purchases assets at a discount to NAV, and therefore shows a strongly positive early interim IRR. This discount amortizes over the holding period of the investment, which can lead to a [naturally] declining IRR as the secondaries fund matures. This results in an IRR-over-time profile distinct from traditional primary funds, where interim IRR tends to start out negative as a result of fee drag and later increases as underlying assets appreciate (sometimes referred to as the j-curve).”

The secondaries n-curve is a structural advantage for early investors where early returns are abnormally positive due to immediate gains from discounted purchases.

The n-curve provides a contrast to the typical J-curve of traditional private equity, where investment returns initially lag targets due to cash drag, transactional expenses, and capex and growth spending before reaping the benefit through growth and ultimately, profits.

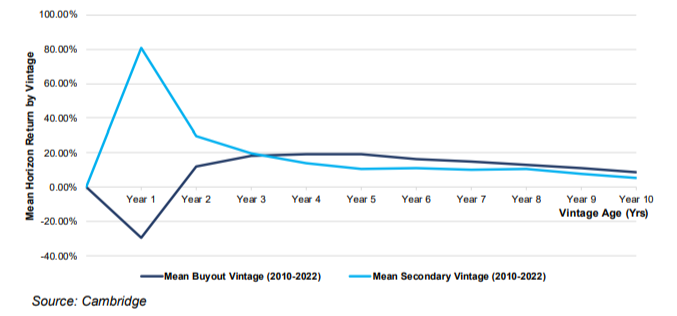

In February 2024, Cliffwater conducted an analysis of secondary and traditional buyout fund performance to demonstrate the secondaries n-curve with real-world data. A comparison of secondaries and buyout vintages from 2010–2022 showed a median IRR of 80% for secondary funds in the first year compared to almost -30% for private equity buyouts.

Figure 1. Private Equity Buyout vs. Secondaries Returns by Year

Source: Cliffwater, Private Equity’s Secondary Act, February 2024

Early investors not only benefit from the n-curve phenomenon, but also maximize their compound growth timeline. Early deployment also ensures participation in any near-term liquidity events or strategic transactions that could generate near-term returns.

Early-Close Advantage

As discussed above, investors experience a positive return arbitrage immediately after the first close as the NAV converges from the discounted purchase price to the fair value. Evergreen secondary funds typically mark straight to underlying NAV to align with GAAP “fair value” accounting principles.

Evergreen secondary funds continuously raise and deploy capital over time, and each fund raise deploys capital at a discount to NAV—which often range from 5% to 20%. At each new close, all investors, old and new, own pro-rata exposure to the entire portfolio from that point forward.

In other words, when a fund adds value through later-close purchases at a discount, everyone who already owns shares participates in the uplift—not just the new investors.

First-close investors benefit from the entire pipeline of discounted secondary transactions. The discount advantage compounds over time as the fund deploys new capital. Later investors still experience NAV uplift from discounts but won’t capture the full compounded discounts of first-close investors.

The following is a hypothetical illustration of the first-close advantage from discount markups. The scenario assumes $100M raises for three fund closes, each having a 20% discount to NAV. This only reflects returns from NAV uplift due to discounts and assumes no appreciation, growth, or underlying “beta” in the fund. Note that each cohort of investors (first-close, second-close, etc.) represents Limited Partners in the same fund.

First close

Fund raises $100M and purchases secondaries at a 20% discount to NAV

Fund is immediately marked up to $125M after close ($100M is 20% less than $125M)

First-close investors’ stake is now $125M (25% return from initial $100M)

Second close

Fund raises additional $100M in fresh capital

First-close investors own $125M of the $225M fund (55.6%); Second close investors own $100M (44.4%)

The new capital is again deployed to purchase $125M of assets at a 20% discount to NAV, and the total fund NAV is now $250M

First-close investors’ stake is 55.6% of the now $250M = $138.9M (38.9% return from initial $100M investment)

Second close investors’ stake is 44.4% x $250M = $111.1M (11.1% return)

Third close

Fund raises additional $100M in fresh capital

First-close investors own $138.9M of the $350M fund (39.7%); Second close investors own $111.1M (31.7%); Third close investors own $100M (28.6%).

The new capital is again deployed to purchase $125M of assets at a 20% discount to NAV, and the total fund NAV is now $375M

First-close investors’ stake is 39.7% x $375M = $148.8M (48.8% return from initial $100M)

Second close investors’ stake is 31.7% x $375M = $119.0M (19.0% return)

Third close investors’ stake is 28.6% x $375M = $107.1M (7.1% return)

Notice with every close, first-close investors’ prorated share of the discounted uplift compounds their returns. Table 1 below compares the hypothetical investor returns through the three closes. To read, start at the first close, read from left to right, and repeat for the second and third close.

Table 1. Illustration of Evergreen Secondaries Returns and the First-Close Advantage

Source: Long Angle Investments

After 8 fund closes of repeating this process (assuming 8 quarters, or 2 years), the annualized IRR for first-close investors is 33.5% before accounting for any growth in the value of the underlying assets. That compares to 22.5% for second-close investors and 18.1% for third-close investors.

In summary, the markups from discounts over time are shared between all investors. The later an investor enters, the pro rata participation in the markup declines. Essentially, early investors leverage later capital to continue to benefit from continuing discounts while later investors buy into some level of beta offset by future discounted buying.

Many funds recycle capital from realized gains into new transactions at discounts rather than immediately distributing it back to LPs (known as DRIP—Dividend Reinvestment Plan). When this happens, even if the discount to NAV narrows for later-close investors the recycling creates continued leverage for all investors. Therefore although first-close investors have an advantage, recycling makes sure that all investors share in ongoing discounts.

As the secondary market matures, it appears that discounts may be narrowing across all fund closes. According to Jefferies’ Global Secondary Market Review, the average pricing for LP-led private equity buyout secondaries portfolios increased from 87% of NAV in 2022, to 91% in 2023, and 94% in 2024. Jefferies concludes that younger vintages and brand-name sponsors are strengthening pricing. If this is indeed a trend and discounts are shrinking across the board, that makes the first-close discount even more advantageous relative to later closes and may signal that the clear arbitrage in evergreen secondaries may be a limited time phenomenon.

Historical Performance

Evergreen secondaries have historically outperformed in early years (the n-curve effect) compared to both public benchmarks and other non-secondary evergreen funds.

Early outperformance vs. public markets

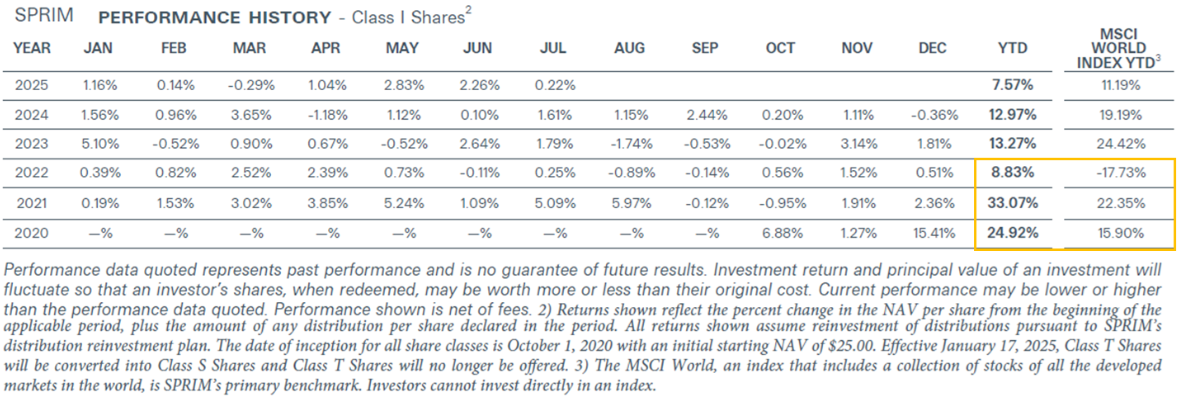

One example of early outperformance is StepStone’s Private Markets (SPRIM) fund, an evergreen secondary fund spanning private equity, real assets, and private debt. SPRIM outperformed the returns of the public benchmark MSCI World Index (as well as the S&P 500) in the first three years since inception. Note that the under-performance in the subsequent 2.5 years versus the public equity benchmark is due to rapid expansion in public market PE multiples, which was not mirrored in private market multiple expansion during this period.

Figure 2. StepStone’s SPRIM Fund Performance (Class I Shares)

Source: StepStone, SPRIM US Fact Card, July 2025

Early outperformance vs. other evergreens

To show how the secondaries n-curve affects evergreen fund performance, Cliffwater analyzed the first twelve months of performance for all 40 Act evergreen PE funds launched since 2020 with observable data to their investment type. Of the eleven funds in the sample, they found:

Funds that were ≥ 50% invested in secondaries returned ~33% on average in the first year

Funds that were < 50% invested in secondaries returned ~11% on average in the first year

Cliffwater focused on a narrower subset of these funds, subject to certain AUM, track-record length, and secondary weight parameters. The remaining three funds, whose names they have omitted, were then reviewed to see if anything of note stood out. While admittedly a small sample size, they did notice a consistent pattern where year-one performance is substantially larger than performance in years two and three. This illustrates the n-curve idea in practice and supports the perception that early adopters of evergreen PE funds with material secondary exposure have benefited relative to investors coming in later.

Figure 3. Sample Performance of Secondary-Heavy Evergreen Funds

Source: Cliffwater, Private Equity’s Secondary Act, February 2024

Strong annualized returns over time

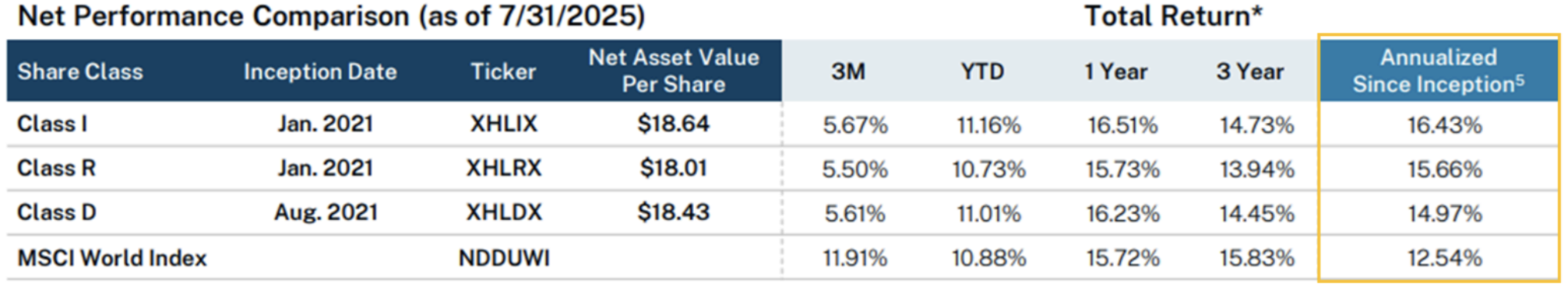

Over longer periods of time, evergreen secondaries can still post stronger annualized returns than alternatives long after the initial years. For example, Hamilton Lane’s Private Assets Fund, an evergreen fund that is 53% secondaries and spans private equity buyout, growth, venture, and private credit, posted stronger annualized returns since inception than the MSCI World Index (and the S&P 500) for all share classes. The same holds true for StepStone’s SPRIM fund.

Figure 4. Hamilton Lane’s Private Assets Fund Returns

Source: Hamilton Lane, Private Assets Fund Fact Sheet, July 2025

High-Net-Worth Asset Allocation Report

Long Angle's annual high-net-worth asset allocation report presents the latest investment trends and strategies for portfolios ranging from high-net-worth to ultra-high-net-worth investors.

Investment and Risk Considerations

Portfolio allocation

Evergreen secondaries can serve as core private equity exposure while reducing the complexity of managing multiple fund relationships and capital calls. They’re particularly attractive for investors who lack the scale to build diversified traditional private equity portfolios with multiple years of capital call schedules and extended illiquidity. For investors new to private equity, evergreen secondaries can serve as an introductory allocation.

Benefits of evergreen secondaries

Prospective investors are typically attracted to:

Discounted buying (as discussed above), leading to the n-curve effect and the first-close advantage of compounding discount markups.

Broad diversification across vintages, industries, geographies, managers, and strategies.

Exposure to mature assets with more predictable cash flows and favorable risk/return profiles. This eliminates the J-curve and blind pool risk associated with private equity and accelerates realizations.

Strong track record from a variety of managers, many of whom are impossible to access for all but the largest institutional investors.

Semi-liquidity through clear redemption guidelines.

Investment Risks

Liquidity risk does exist despite the semi-liquid structure. Most evergreen funds impose capped quarterly or semi-annual redemption windows with advance notice requirements. In a major market correction when credit is tight and investors all run for the exit at the same time, there are likely to be redemption gates. Managers cite this as a positive so they aren’t forced to fire sale assets, but investors should know that liquidity is likely only to exist in normal market conditions, not in severe pullbacks or recessions.

Valuation risk arises from the inherent difficulty in pricing illiquid private equity assets and the potential for NAV-based pricing to diverge from true market values. There are some examples of large funds running into some pricing challenges like BREIT, but like public markets, investors should take a keen look at the valuations they are buying into and the underlying methodology.

Manager risk encompasses operational complexity and specialized expertise. Effective management requires sophisticated due diligence, networks, and operations. Investors should only rely on managers who have extensive secondaries and private equity experience.

Correlation risk can apply depending on the fund type. A pureplay private equity fund may have a tighter correlation with public markets than an all weather private markets fund, real estate, venture, or infrastructure. Be aware of the underlying assets and diversification goals.

Due diligence framework

Investors should carefully evaluate the following before committing capital:

Manager experience: deal sourcing, due diligence, portfolio construction approaches, operations. Given the fundraising dynamics and attributes of the n-curve discussed above, the manager’s ability to fundraise and manage the fund is critical.

Track record across market cycles: net returns, risk-adjusted returns, consistency across funds and vintage years, comparisons to benchmarks.

Valuation Policy: how are the underlying assets valued and does it make sense given the overall market environment?

Realization Record: to the point on valuation, how close is the manager’s record in evaluating the net asset value before disposition? The best managers realize returns well in excess of pre-sale valuations bolstering the investment thesis; the worst managers realize returns below where they hold the assets, significantly dragging the portfolio and drawing into question the validity of their marks.

The chart below is an analysis by StepStone that compares the top quartile, median, and bottom quartile of private equity fund managers and the premium or discount of the exit valuation to their evaluations 5 quarters prior (T-5Q). Anything over 0% means positive realized returns.

Figure 5. Exit Valuations vs. T-5Q Valuations

Source: StepStone Portfolio Analytics & Reporting; as of Q1 2025

Fees: secondary funds have fees on top of fees. Normally this is well offset by the extra value you get from diversification, strong underlying assets, and discounted entry positions, but it is very important to be hyper aware of the total fee and expense drag from any investment.

Long Angle members can reach out to the Long Angle Investments team with any questions on evergreen secondary funds, due diligence, and opportunities to invest. Non-members can learn more about Long Angle at longangle.com and apply for membership here.

Frequently Asked Questions

What are evergreen private equity secondaries?

Evergreen secondary funds offer investors access to existing interests in a private fund or asset via a perpetual investment vehicle.

Why invest in evergreen secondaries?

Semi-liquidity

Full upfront capital deployment

Purchase discounts

Diversification

Elimination of the J-curve

N-curve and the early-close advantage

What is the secondaries n-curve?

The secondaries n-curve is a structural advantage for early investors where early returns are abnormally positive due to immediate gains from discounted purchases.

What is the early-close advantage with evergreen secondaries?

First-close investors benefit from the entire pipeline of discounted secondary transactions. The discount advantage compounds over time as the fund deploys new capital. Later investors still experience NAV uplift from discounts but won’t capture the full compounded discounts of early-close investors.

What should investors consider when evaluating evergreen secondary opportunities?

Risk considerations:

Liquidity risk

Valuation risk

Manager risk

Correlation risk

Manager considerations:

Manager experience

Track record across market cycles

Valuation policy

Realization record

Fees

Ready to connect with like-minded peers navigating similar wealth decisions?

Join Long Angle, a private community where successful entrepreneurs, executives, and professionals collaborate on wealth strategies, investment opportunities, and life's next chapter.