Private Equity Secondaries Investments Guide 2025

Source: Capital Dynamics

Looking for a trusted network of high-net-worth peers? Apply now to join Long Angle, a vetted community where successful investors, entrepreneurs, and professionals connect. Access confidential discussions, live events, peer advisory groups, and curated investment opportunities.

Part 2 of the Evergreen Secondaries Series: Long Angle’s Secondaries Investment Guide 2025 is a comprehensive introduction to private market secondaries. The guide explains the fundamentals of secondaries investing, outlines key benefits for investors, and compares the dynamics of LP-led versus GP-led transactions. It also clarifies common terminology and highlights performance characteristics to help readers more confidently evaluate whether secondaries are a fit for their portfolio.

Table of Contents

Download the Full Investment Guide Here

What are Private Equity Secondaries?

A secondary transaction is the transfer of existing interests in a private fund or asset to a new third-party investor.

The secondary market is growing rapidly across private asset classes, including private equity, private credit, venture capital, and real estate. Secondaries exist for several reasons, including:

To provide liquidity to existing Limited Partners (LPs—investors who contribute capital) before natural liquidation.

To extend the life of a fund or asset for General Partners (GPs—fund sponsors who manage the investment).

To meet the demand from new investors for access to pre-vetted, mature assets managed by experienced teams.

There are two types of secondary transactions:

LP-led: An existing LP sells their assets to a new investor.

GP-led: A GP negotiates with a buyer to purchase the remaining assets in a fund that is nearing the end of its legal term.

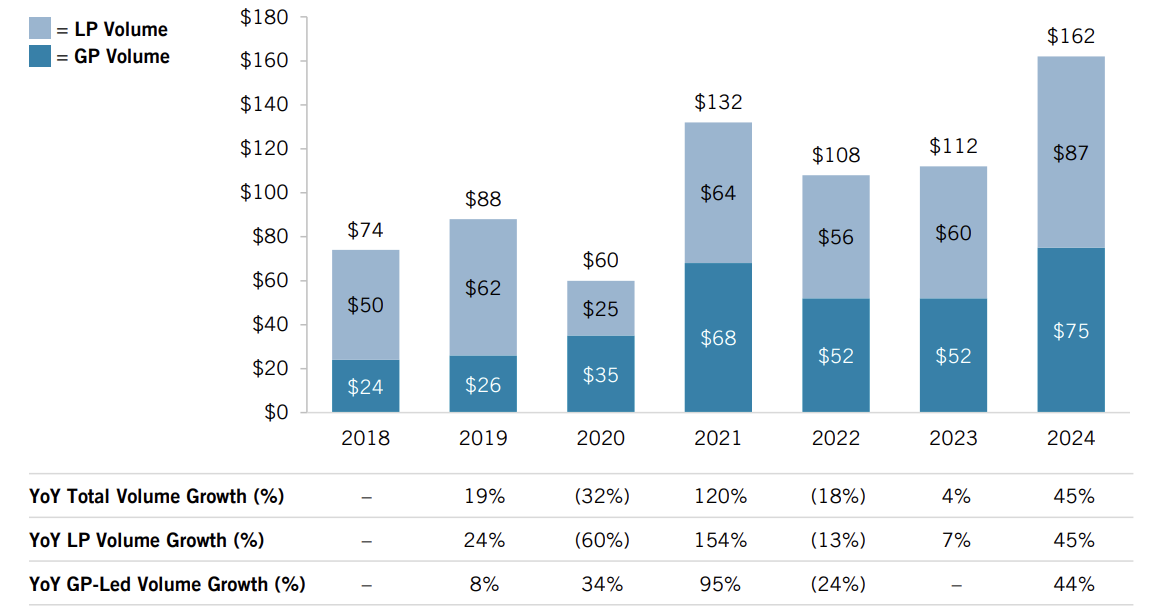

According to Jefferies’ Global Secondary Market Review, global secondary volume hit new highs in 2024 across both LP- and GP-led markets.

Figure 1. Annual Secondary Transaction Volume ($B)

Source: Jefferies, Global Secondary Market Review, Jan 2025

What are LP-Led Secondaries?

LP-led transactions are when an existing LP sells their assets to a new investor. These are often entered to provide the seller with liquidity before the natural end of the life of a fund or asset.

LPs may choose to sell for a variety of reasons, including:

Rebalancing portfolios by selling overweight asset types.

Liquidity: selling assets when in need of capital due to distress.

Exiting the fund prior to the contracted fund life.

There are three major benefits to LP-led secondaries for new buyers:

Discounted purchase price

LP-led secondary assets are usually sold at a discount to net asset value (NAV), or the total value of an entity’s assets minus liabilities.

LP-led secondary investors typically receive a discount below a fund’s NAV as an incentive to invest and provide liquidity for existing owners. Once the discounted investment is made, its value sees an immediate markup.

This discounted purchase price and immediate markup is one of the primary reasons new buyers invest in LP-led secondaries. Average secondary discounts can range from a few percentage points to over 30% depending on market conditions and asset classes. According to Jefferies, average pricing for portfolios of all strategies settled to 89% of NAV in 2024.

Figure 2. LP Portfolio Pricing by Secondary Asset Class (% of NAV)

Source: Jefferies, Global Secondaries Market Review, Jan 2025

Broad Diversification

Another major appeal to LP-led secondaries for new investors is broad diversification. Secondary funds often comprise hundreds of underlying assets (e.g., companies) across vintage years, industries, geographies, managers, and strategies.

Eliminating the J-curve

Secondary investments into mature assets eliminate the initial cash drag associated with typical primary private equity funds. See a fulsome discussion on the J-Curve below in Performance Characteristics.

Long Angle has participated in a few LP-led secondary offerings, including:

What are GP-Led Secondaries?

GP-led transactions are when a General Partner (GP) negotiates with a buyer (or syndicate of buyers) to purchase the remaining assets in a fund that is nearing the end of its legal term, or to recapitalize a single asset in a fund (often referred to as a “Continuation Vehicle”). Existing LPs in the target fund are then offered the opportunity to sell their interests to the new fund or remain invested.

GPs can coordinate a secondary transaction to give themselves more time to maximize the growth of trophy assets. In private equity, GPs often use secondaries to extend ownership of their best-performing portfolio companies. This eliminates what’s known as “blind pool risk.”

Investing in GP-led secondaries can eliminate “blind pool risk” in traditional private equity, where investors commit capital for the future acquisition of assets and underlying companies they have no knowledge of.

There are a couple of features of GP-led secondaries that investors should look out for:

GP-led transactions are often sold at or close to NAV (i.e., no or little discount). New LPs still benefit from investing in mature secondary assets, but they don’t experience the same discount markups as LP-led transactions.

GP-led secondaries are often single asset vehicles, meaning they don’t have the same diversification benefits as LP-led.

To ensure aligned incentives, new LPs should check if the GP is maintaining a heavy interest in the new fund (e.g., rolling most of their carry and/or equity).

New LPs should also examine the fee structures carefully to see how many fee layers they are exposed to (the underlying manager/asset, as well as the secondary manager).

The following table summarizes the pros and cons of LP- and GP-led secondary transactions:

Table 1. LP-led vs. GP-led Secondaries: Pros and Cons

| LP-led Secondaries | GP-led Secondaries | |

|---|---|---|

| Pros | For Sellers: Liquidity to LPs without waiting for fund maturity; Portfolio rebalancing opportunities; Large, active market with many buyers | For Sellers: Extends ownership of high-quality assets past original fund life; GPs continue managing familiar assets; Existing LPs can choose to roll into the new vehicle or liquidate |

| For Buyers: Discounted purchase price leading to immediate markups; Diversification across vintage years, industries, strategies, etc.; Eliminating the J-Curve; Lower blind-pool risk | For Buyers: Often concentrated in “trophy” assets with strong performance; Eliminating the J-Curve; Lower blind-pool risk | |

| Cons | For Sellers: Sold at discounts to NAV to incentivize buyers | For Sellers: Complexity in fund set-up, negotiations, and management |

| For Buyers: Not necessarily “trophy” assets compared to GP-led transactions (investors need to examine the sponsor track-record and experience carefully) | For Buyers: Little to no purchase discounts; Often concentrated to single asset vehicles (less diversification); GP interests could be misaligned if they don’t maintain a heavy interest (e.g., carry/equity) in the new fund |

Source: Long Angle Investments

High-Net-Worth Asset Allocation Report

Long Angle's annual high-net-worth asset allocation report presents the latest investment trends and strategies for portfolios ranging from high-net-worth to ultra-high-net-worth investors.

Performance Characteristics

While LP- and GP-led secondaries each have their unique benefits and downsides, there are some more broad benefits to the category as a whole.

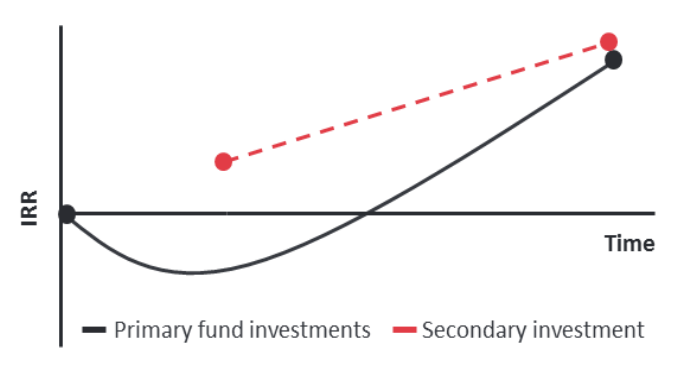

Eliminated “J-curve”

The J-curve is the cash drag (e.g. legal fees, transactional expenses, initial management replacement, capex and growth spending, etc.) associated with the beginning stages of a typical primary private equity fund. This results in an early negative internal rate of return (IRR). With secondaries, the underlying assets are already mature, have more predictable cash flows, and have more favorable risk/return profiles.

Secondary investors enter after a fund or asset has stabilized and grown, so as management executes on its strategy the assets appreciate and provide a positive return. This timing therefore eliminates the J-curve effect, leading to positive IRR following the initial investment.

Figure 3. Illustration of J-curve Elimination with Secondaries

Source: Capital Dynamics, Introductory Guide to Investing in Private Equity Secondaries - Third Edition, July 2016

Accelerated distributions

Just like with the elimination of the “J-curve,” due to the composition of mature and best-performing assets, existing investments that may be generating current cash flow or are nearer to sale/realization can result in accelerated distributions for LPs.

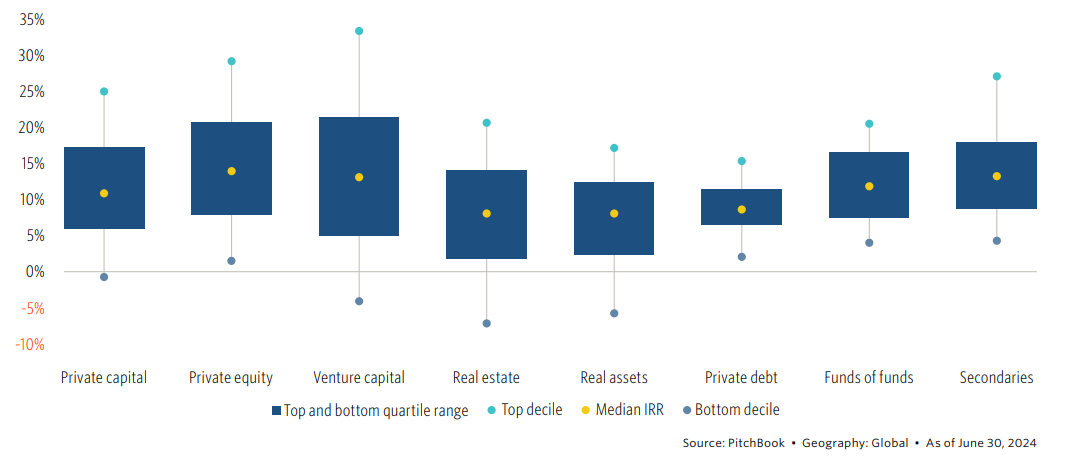

Historical outperformance

By focusing on mature assets, secondaries have historically offered attractive returns with reduced risk relative to other private market strategies.

According to a McKinsey & Company analysis, secondary funds have posted the highest median returns of any private market asset class for 2012-2021 vintage funds. Not only has the median outperformed, but so has the top quartile of secondary funds (#2 in IRR only to private equity) and the bottom quartile (#1 in IRR by nearly 4 percentage points).

Figure 4. Performance by Asset Class: median IRR and percentile spreads from 2012-2021 vintage funds (%)

Source: McKinsey & Company, Secondaries and GP stakes: The next wave of private market innovation, May 2025

McKinsey explains that part of the reason secondaries outperform is that they offer a hedge to private markets. During recessionary periods, the overall beta/value of the assets declines like any other fund, but purchase discount spreads tend to increase due to limited liquidity.

It is also interesting to note that the variance between top and bottom quartile managers is much more limited than in private equity, real estate, or venture capital, suggesting that manager selection isn’t quite as critical in secondaries as other asset classes (see chart below).

Figure 5. Fund Performance Dispersion by Strategy (vintage years 2005-2019)

Source: Pitchbook, Global Fund Performance Report, Q2 2024

Good timing for buyers

Given limited IPO and M&A activity, lengthening fund life, and extensive need for seller liquidity, the current secondary market appears advantageous for buyers. According to PitchBook, secondaries fundraising surged in Q1 2025 with capital raised reaching nearly half of 2024’s full-year total.

To learn more about secondary fund lifecycles, evergreen secondaries, and how first close investors benefit from positive return arbitrage, read Long Angle’s Evergreen Secondaries Investment Guide 2025.

Long Angle members can reach out to the Long Angle Investments team with any questions on secondary funds, due diligence, and opportunities to invest. Non-members can learn more about Long Angle at longangle.com and apply for membership here.

Frequently Asked Questions

What are secondaries?

A secondary transaction is the transfer of existing interests in a private fund or asset to a new third-party investors.

What are the benefits of secondaries investing?

Enhanced liquidity for existing LPs

Discounted purchase price for buyers

Broad diversification

Eliminating the J-curve

Eliminating blind pool risk

What are LP-led secondaries?

An existing Limited Partner (LP—investor who contributes capital) sells their assets to a new investor.

What are GP-led secondaries?

A General Partner (GP—fund sponsor who manage the investment) negotiates with a buyer to purchase the remaining assets in a fund that is nearing the end of its legal term.

What are discounts to NAV?

LP-led secondary investors typically receive a discount below a fund’s net asset value (NAV) as an incentive to invest and provide liquidity for existing owners. Once the discounted investment is made, its value sees an immediate markup.

What is the J-curve? How do secondaries eliminate it?

The J-curve is the cash drag (e.g., legal fees, transactional expenses, initial management replacement, capex and growth spending, etc.) associated with the beginning stages of a typical primary private equity fund. This results in an early negative internal rate of return (IRR).

Secondary investors enter after a fund or asset has stabilized and grown, so as management executes on its strategy the assets appreciate and provide a positive return. This timing therefore eliminates the J-curve effect, leading to positive IRR following the initial investment.

Ready to connect with like-minded peers navigating similar wealth decisions?

Join Long Angle, a private community where successful entrepreneurs, executives, and professionals collaborate on wealth strategies, investment opportunities, and life's next chapter.